Q1 2024 Summary

Portfolio +25.8% vs SPY +10.4%.

The overall returns from Q1 ended at 25.8%, in which both shorts and longs contributed, but the shorts performed far better on a relative basis. On average, I was running 140-something % long and 40-something % short, for an average net positioning of around 95%.

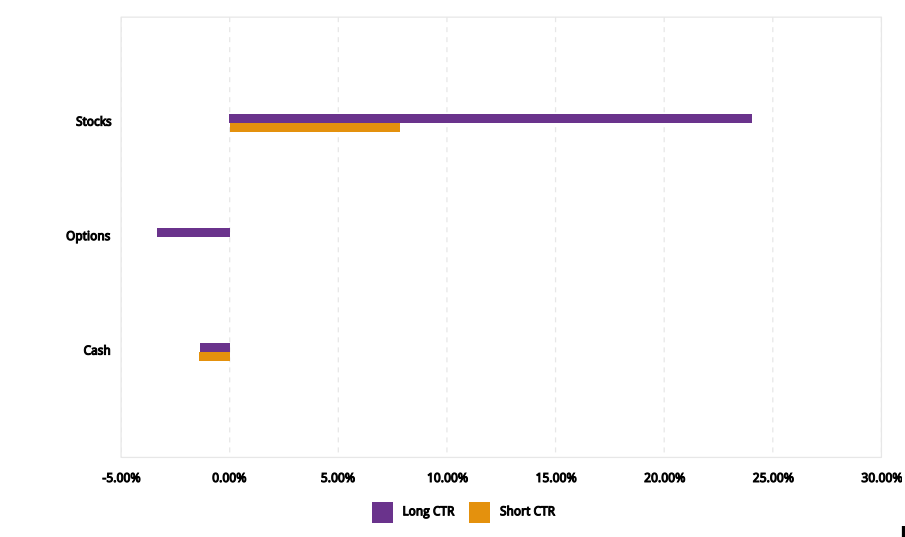

Performance by Long and Short

The gross long returns for the quarter look good on the surface, being up 21% (net of the -3% from options), compared to a SPY return of 10.4%. However, adjusted for leverage and currency effects, the returns were similar to the S&P500.

I averaged a bit more 140% long for the quarter, giving about a 15% leverage-adjusted return( 21% return/1.4 leverage = 15% return). From that number, a couple of percent can be deducted for margin cost, and a couple of percent can be deducted due to currency tailwinds (weak base currency), to arrive at an adjusted long performance more or less similar to the S&P500.

My short positions performed very well, contributing 8% to the portfolio for the quarter, while running between 40% and 50% short on average. Most of my shorts are small and micro caps, and the most comparable index (Russel 2000) was up 5% for the quarter. I ascribe the short outperformance mainly to five shorts that either filed for bankruptcy or were delisted for other reasons.

My next post on this blog, hopefully coming pretty soon, will be about shorting as a retail investor. It will contain some controversial views, and I will detail my process.

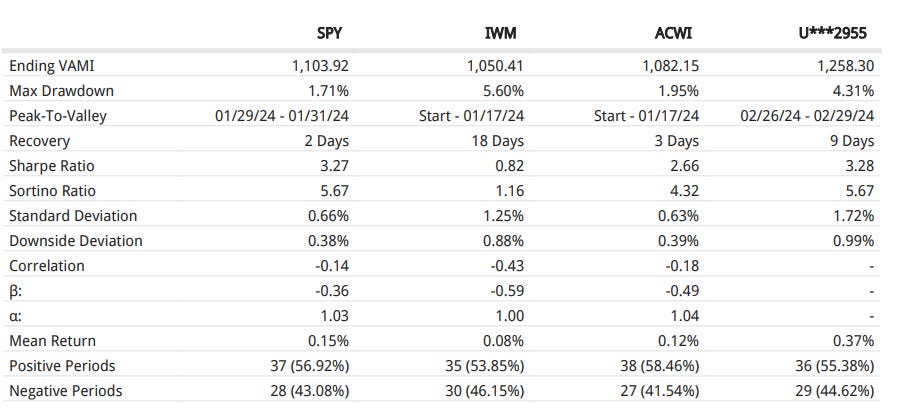

Risk Measures

Interactive Brokers claim I had a negative beta to the major indices I compare to. I ascribe that to shorts going down more than the general market on down days, and my energy longs being more correlated to energy prices than any stock indices - And frankly, sectors like oil tankers, unless crude oil prices are making significant moves, are generally living their own lives.

While it’s cool to have negative beta and to generate alpha, that’s not a goal in and of itself. If I believed Apple and Microsoft were the most undervalued stocks on the market, I would own only them.

Anyways, another interesting tidbit is how insanely similar my Sharpe Ratio and Sortino Ratio were to SPY, despite the previous discussion. Which leads to another controversial opinion.

I’m not too fussed about some of the most common risk measures. I don’t find day-to-day volatility to be a good measure of risk, and I don’t think a retail investor should care too much about volatility. For example, tankers, as mentioned above, tends to be highly volatile - However, if you have a strong view about where the sector will be in 18 months, you must ignore the days when everything is down 6% on no news, which happens quite frequently. That’s just something you have to stomach in some sectors. Which again might scare institutional investors away, creating opportunity.

Logically, a volatile stock gives you more opportunities to buy at a greater discount to fair value, and more opportunities to sell at a greater premium to fair value than a non-volatile stock. But that’s a topic for another time. Or maybe I will change my mind before that another time comes.

General Commentary

In brief, this quarter was good.

However, I don’t feel that good about my portfolio at the moment.

There are two reasons for that.

Reason number one is FOMO.

There are stocks on my watchlist up more than 30% in the first quarter. This includes a stock I briefly held in October of last year, but sold because I couldn’t really gain conviction. I would have been up 80% on that one now…

The markets in Q1 has been crazy, and I guess whining about stuff I missed, while being up 25% in three months, is a testament to it.

Reason number 2 is that I don’t know where my future long returns should come from. That was true at the quarter end, but even more true at the time of writing a week later. I felt good about most positions at the beginning of the year and believed that most of my stocks were severely undervalued. Now the situation is different.

Many of the positions I was excited about three months ago are definitely within a fair value range now. And I haven’t had a new exciting idea for a little while. I’m therefore not looking forward to the next 3-6 months.

I’ll give an example using the previously mentioned tanker stocks.

As a Norwegian, I have this terrible disease that causes an unhealthy fascination for anything that floats. Especially if it’s made of steel. You know, ships, oil rigs and such. I’m sure the cumulative profits of everything that has ever floated throughout history are negative. As you can imagine, it’s a costly disease. However, you have a few lucky years every so often. And you better take advantage of them before Fortuna leaves.

I’ve had a sizeable allocation to tankers for a couple of years, but the positions have been front of mind recently. Which probably means I should cut my exposure. You see, tankers are earning tons of money at current rates, and the market is very tight, but everyone knows that. The tanker bulls will argue that current rates are sustainable for at least three more years due to a low order book (depending a bit on the segment). If so, the stocks could be cheap-ish. But everyone also knows that.

I’m questioning myself: “What will re-rate the stocks from here?”. I’m not investing in cyclicals to earn a market-ish rate of return.

Shipping is as efficient as possible. If “anything” changes, transportation efficiency is reduced, increasing freight rates and earnings for ship owners. And any reversal of that change will reverse the effect. Currently, you have the Houthi’s attacking ships in the Suez Canal, sanctions on Russia, and reduced transit in the Panama Canal all causing elevated freight rates. If any of these were to reverse, rates would fall, and tanker earnings would follow.

The only positive re-rate event I see for tankers is that the Saudis might turn on the oil taps again if the demand is strong, meaning that oil prices need to stay at these levels ($85+ WTI) for a while. Given a very tight market, this could probably make rates for the largest crude tankers (VLCC’s) go from elevated to crazy. And the VLCC’s are the tanker segment with the lowest order book.

However, the companies with significant VLCC exposure (DHT, FRO, OET) are more expensive than non-VLCC-having crude tanker stocks, and product tanker stocks, both on an earnings basis and a price-to-NAV basis. I believe the market largely has priced in the longer duration of elevated rates for VLCCs, given the limited increase in fleet supply. But I still think a potential increase in Saudi crude flow could cause a re-rate.

I will probably say bye-bye to product tankers and sell half of my Frontline (FRO) shares. Keeping the rest to still have some VLCC exposure. One might still make tons of money in tankers over the coming years, but the risk/reward has come down drastically, in my view. And the shipping sector (as opposed to the actual ships) can turn on a dime.